The Winner Effect - Implications for Stock Picking and Multibaggers

Winners keep winning. Losers keep losing.

The 'winner effect' is a term used in biology to describe how an animal that has won a few fights against weak opponents is much more likely to win later bouts against stronger contenders.

The ‘winner effect’ applies to humans as well - winning, or even the perception of winning, changes the chemistry of the brain. Consistent releases of testosterone and dopamine in our brains eventually change our nervous system and endocrine systems such that they encourage more winning. Of course, this self-reinforcing positive feedback loop is great for winners.

But it’s the exact opposite for losers.

In short:

Winners keep winning.

Losers keep losing.

Interestingly, the same phenomenon occurs in companies as well. In 2013, Bryant Matthews and David Holland at Credit Suisse published a piece titled “Was Warren Buffett Right: Do Wonderful Companies Remain Wonderful?”

The key findings were:

Corporate profitability is sticky. Good companies tend to remain good companies, and poor companies tend to remain stuck in the mud. Sustainable corporate turnarounds are difficult to execute, and investors should be careful about overestimating the odds of success.

Companies in defensive industries exhibit more stickiness in corporate profitability than firms in cyclical industries. The reputation of the business tends to remain intact regardless of industry. Companies with an operational edge tend to maintain it, and those without it tend to repeat their operational mistakes.

Firms with excellent profitability tend to outperform those with the worst return on capital. The outperformance improves if high quality firms are purchased at a fair price. The outperformance can be further improved by purchasing quality firms at a fair price that are exhibiting positive relative momentum.

The transition matrix below highlights how sticky corporate profitability is - once in an extreme (bad Q1, good Q4) quartile, the probability of staying in that quartile is >50% (if performance was random, the probability would be ~25% since there are 4 states).

The main takeaway is that investors should try to stay away from turnarounds, unprofitable companies and gravitate towards operationally profitable ones. The base rate of success is just simply higher.

Still not convinced? Further evidence comes from some multibagger studies:

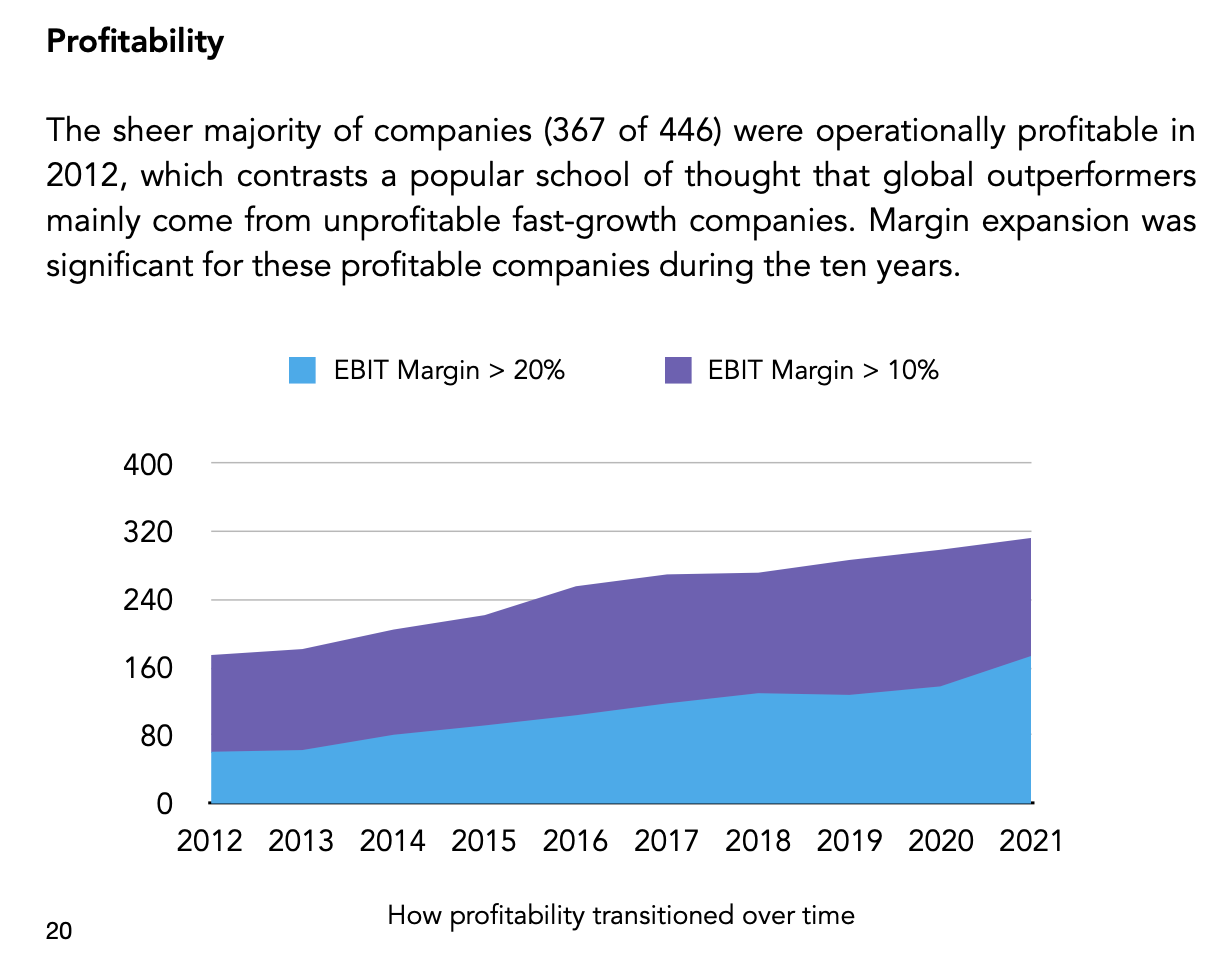

Dede Eyesan at Jenga Investment Partners published a book titled Global Outperformers in 2022 (free to download if you provide some information), where he studied listed companies that returned more than 10x in 10 years. One of the points on profitability was that 367 / 446 (~82%) were profitable back in 2012.

In 2020, Alta Fox published a study called The Makings of a Multibagger, which analyzed stocks that had returned more than 3.5x in the last 5 years. The two relevant takeaways for this post are:

Spend time on financially healthy companies: 88% of outperformers came from a position of financial health in June 2015 and grew faster than the market might have anticipated. Looking for financially healthy companies, rather than turnarounds, is also less risky.

Companies trading below 3x NTM Sales, 20x NTM EBITDA, and 30x NTM PE and/or those without forward multiples: 82% of companies from the set traded below these multiples or without forward multiples five years ago

If winning companies keep winning and losing companies keep losing (on a fundamental level), then perhaps price momentum is just a derivative of fundamental momentum…