Back-of-the-Envelope Write-Ups (#1)

Natural Resource Partners L.P. (NRP): Hard Asset / Capital-Light Company, Lots of Free Options & Insiders Own 28%

Back-of-the-Envelope Write-Ups will be short write-ups on interesting companies that I’m currently turning over and will contain the following sections:

Investment Thesis

Background

Valuation

Risks

Catalysts

Additional Reading

Sosnoff's Law: “the price of a stock varies inversely with the thickness of the its research file. The fattest files are found in stocks that are the most troublesome and will decline the furthest. The thinnest files are reserved for those that appreciate the most.”

Investment Thesis

NRP is an interesting opportunity to buy shares in a hard asset, capital-light royalty business at a cheap valuation. With ~1.2b enterprise value (EV), it operates under-the-radar and has been using FCF to pay down debt, redeem preferred equity, and increase distributions. Insiders own 28% of the company and investors also get a free option on its carbon neutral initiatives.

Background

Natural Resource Partners L.P. NRP 0.00%↑ is an MLP formed in 2002. It manages / leases a diversified portfolio of mineral properties in the US and owns a 49% non-controlling interest in Sisecam Wyoming (fka Ciner Wyonming), a soda ash production business.

The business is organized into two segments:

Mineral Rights (~85% revenues): consists of ~13m acres of mineral interests and other subsurface rights across the US (coal, oil/gas, industrial metals, timber)

Carbon Neutral Initiatives: in an effort to identify alternative revenue sources, NRP is exploring forest carbon sequestration, subsurface carbon dioxide sequestration, and renewable energy production; they do not plan on developing / operating any projects themselves, but will lease acreage to other companies in exchange for payment of royalties / fees

Soda Ash (~15% of revenues): 49% non-controlling equity interest in Sisecam Wyoming, which mines trona and processes it into soda ash

Valuation

Market Cap: $800m (current price ~$64, 12.5m shares)

Total Debt: $168m

Preferreds: $250m (250,000 units at $1,000 par value per unit)

Cash: $39m

Enterprise Value: ~$1.2b ($800m + $168m + $250m - $39m)

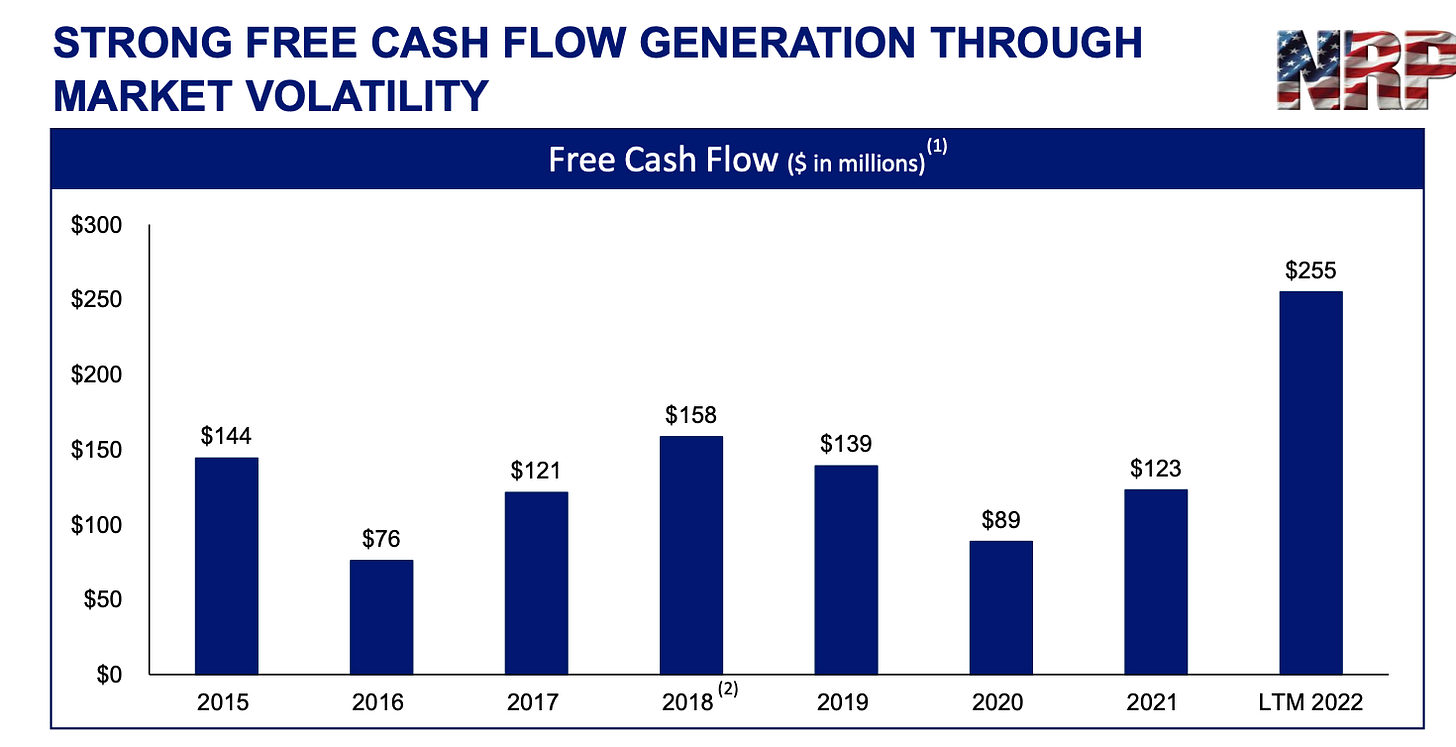

NRP generated ~$270m of FCF in 2022 but eyeballing historical FCF, it seems to generate ~$120m every year. Using that as a normalized number, we get that NRP is trading ~10x EV/FCF.

However, it also makes sense to look at the business from a sum-of-the-parts perspective:

Soda Ash (49% stake): SIRE 0.00%↑ owns the remaining 51% of Sisecam Wyoming and is currently trading ~$500m

Mineral Rights: generates a conservative $120m FCF a year; if you assume a 5x multiple, you get $600M

In short, you get ~$1.1b in value for just the soda ash and mineral rights business (around its current EV). If you back out the soda ash business, you are paying 5x FCF for the mineral rights segment and getting the carbon neutral segment as a free option, which could generate FCF at little/no costs

Risks

Coal Prices/Volumes Fall: shouldn’t be an issue as the royalty business model should generate positive FCF through a full cycle and historically, FCF has been positive

Poor Capital Allocation: always a risk so keep an eye out for poor capital allocation decisions

Peak Coal: for those worried about if coal is here to stay, in 2022, the world’s coal consumption was near new highs; the end of coal seems decades away

Catalysts

Good Capital Allocation: continued use of FCF to pay down debt, redeem preferred equity, de-risk the capital structure and increase distributions

Carbon Neutral Projects: build out its carbon neutral projects, which would increase FCF with minimal expenses

Sustained Inflation: if we do see continued inflation, the royalty business model should benefit, since the business can increase revenues without a commensurate increase in costs (see Royalty Companies: "Inflation, I Win; Disinflation, I Don’t Lose Much.”)

Aligned Insiders: directors and officers collectively own ~28% of the company

Additional Reading

Quick question: Do you know anyone who has received NRP’s K1? I’m studying the tax situation with MLPs and turns out UBTI can be potentially huge in dragging down returns if invested from tax-advantages accounts like IRAs. Since NRP is a royalty company, its income is potentially exempt from UBTI, but I’m not so sure.